VA Loan Limits 2021: Maximum Amount by State

Table of Content

Surviving spouseThe Veterans discharge documents if available and other documents depending on if you’re receiving Dependency & Indemnity Compensation benefits. So the size of your VA loan now depends more on your financial credentials than on the local housing market. VALoans.com is not affiliated with or endorsed by the Department of Veterans Affairs or any government agency. Visitors with questions regarding our licensing may visit the Nationwide Mortgage Licensing System & Directory for more information. By using, you will be matched with participating members of the ICB Solutions network who may contact you with information related to home buying and financing.

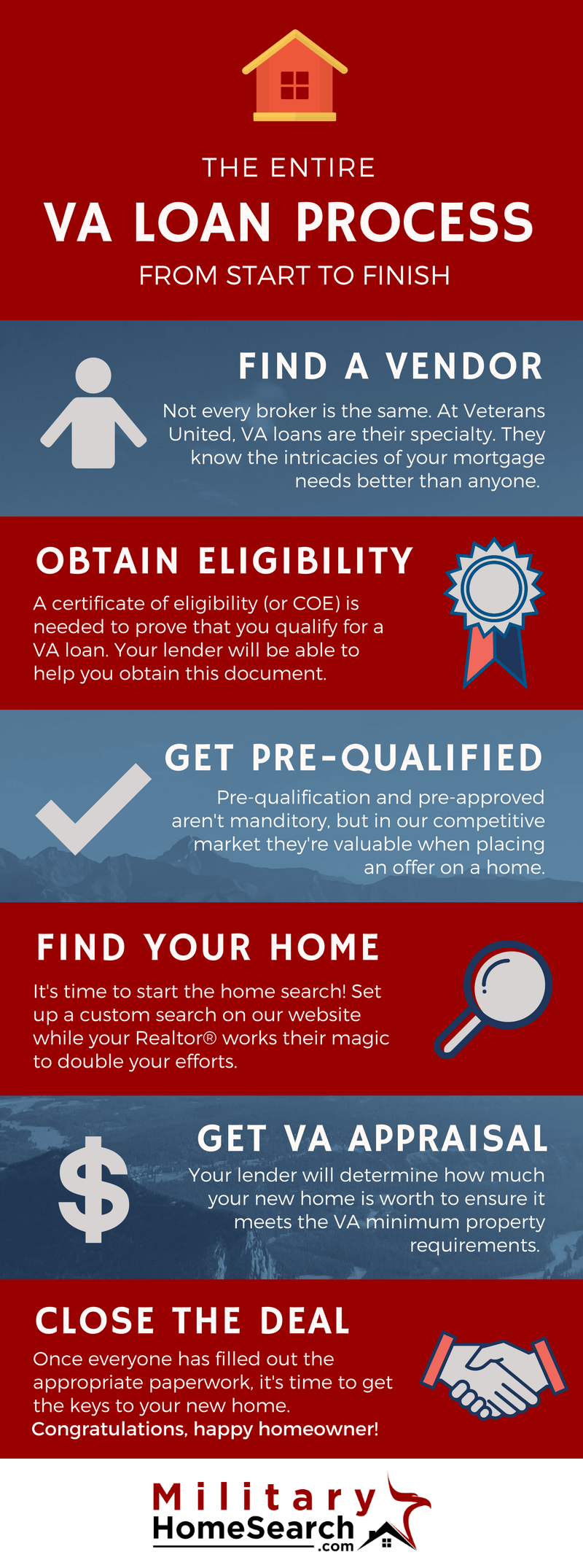

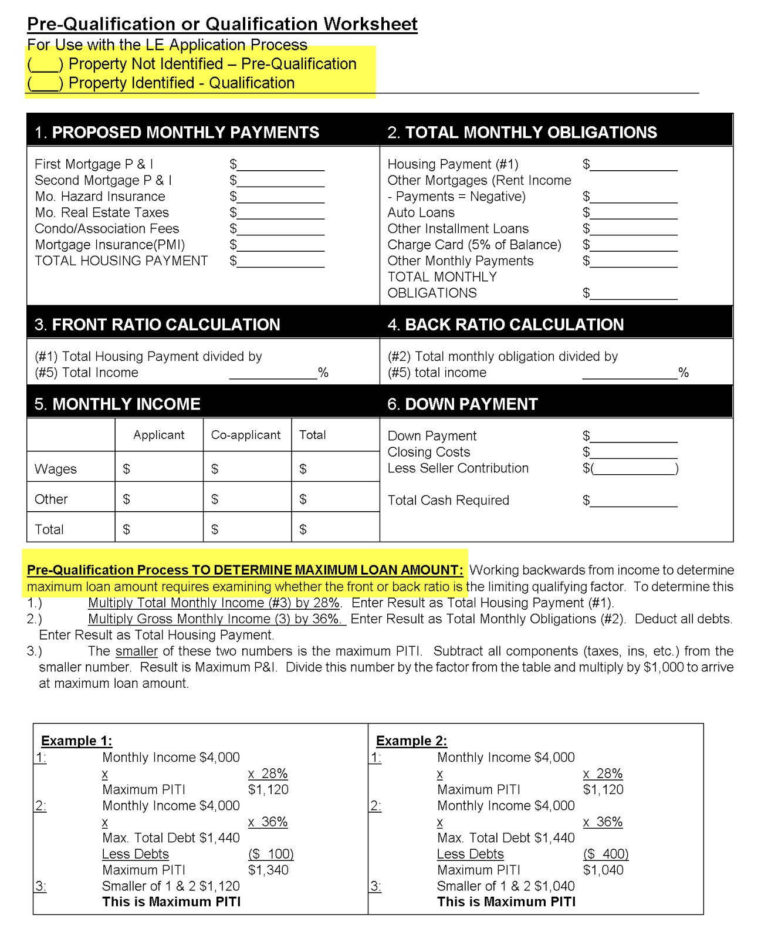

If you decide to work with a realtor, it’s a good idea to find one who is familiar with VA loans. As weve just covered, VA loans come with their own set of limits and complications and working with a real estate agent who doesnt know the system can make the homebuying process more of a headache. If you want to buy a home that costs more than the loan guarantee, you need to make a down payment, usually 25% of the amount above the VA loan limit. If you dont currently have VA entitlement, your lender is the best resource for determining your maximum VA loan limit. However, if you want to crunch some numbers yourself, heres an example of how the calculations would work. A VA approved lender; Not endorsed or sponsored by the Dept. of Veterans Affairs or any government agency.

d Tier Entitlement Calculation

On your COE, in the table called Prior Loans charged to entitlement, we list the amount of your entitlement you’ve already used under the Entitlement Charged column. Your entitlement can be restored when you sell your property and pay your VA-backed loan in full, or repay in full any claim we’ve paid. Instead, it means that if you default on a loan that’s under $144,000, we guarantee to your lender that we’ll pay them up to $36,000. For loans over $144,000, we guarantee to your lender that we’ll pay up to 25% of the loan amount. The VA loan entitlement maximum is $36,000 unless the loan amount is above $144,000. Because of this, a borrower may have more than one VA home loan at a time.

The only way to lose your VA loan entitlement is from not paying off prior VA loans. This is a one-time use where you've paid off the VA loan but decided to keep the property. Secondary Entitlement – Because the VA understands that most houses cost more than $144,000, they provide secondary entitlement. This means that the VA further guarantees $137,062, which is a quarter of $548,250 . Here’s what you need to understand about VA loan entitlement. You have paid the previous VA loan fully and have sold the property.

Auto Loan Bad Credit Instant Approval No Money Down

Department of Veteran Affairs’ (VA’s) Five Year Plan to End Homelessness Among Veterans. This plan was born out of the goals and timeframes set forth by the legislators, governors, nonprofits, faith-based and community organizations, the U.S. If your previous home was purchased using a VA Loan, and that loan was paid off by the new owners, the full entitlement may have been restored. The Veteran's Administration also allows Veteran Homeowners to refinance from a Conventional loan to a VA mortgage Loan. In August 2012, Congress passed a bill that allows a Veteran to receive the benefits of having Veteran Disability while it is still pending.

COE is the document proving that active-duty service members and veterans meet the service requirements to be eligible for a VA home loan. It’ll also contain information about your entitlement amount. As of January 1, 2020, VA loan borrowers with full entitlement don’t have a limit on how much they can borrow with a 0% down payment.

The Bottom Line: Entitlement Helps You Understand How Much You Can Borrow With Zero Down

Some Certificates of Eligibility will show 1) total entitlement, and 2) available entitlement among other data.

While these new loan limits are effective immediately, loans using the new limit must close on or after January 1, 2023. For example, if you want to buy a home that costs $747,200 in a county with a loan limit of $647,200, you would likely need to make a $25,000 down payment . If youre a military servicemember or veteran, you may have access to a zero-down loan with no limit, as long as you qualify for the payment.

Basic Entitlement And Bonus Entitlement Together Are Enough For A Va Loan Of $417000 Or More

When you look up the VA loan limits in your county, the number you see wont tell you the maximum value of the home you can get with a VA loan. Instead, it tells you the limit of what you can get if you put $0 down. Lets assume youre currently using $60,000 of your VA loan entitlement and want to purchase a new home in a standard cost county .

In this article, we cover everything you need to know about loan limits in your state. This is the only column that applies to VA home loan limits. It was established in 2009 to support the execution of the U.S.

It’s a perfect time to buy a home near your station or to settle down near family in your last home. The VA is a government agency that understands you and your partner may be stationed or retiring in a more expensive part of the country, such as California. They adjust VA Loan Limits according to the cost of living of the particular county. Calculating your remaining VA Entitlement can be done on your own or with the help of an experienced lender. Basic, 2nd Tier, and remaining entitlement calculations are the most common we see with the home buyers we work with.

Entitlement can be confusing for even the most experienced mortgage professionals. In most areas of the country, basic entitlement is $36,000. Adding those together gives you a total of $106,024 for eligible veterans. In higher cost areas, it may be even more.Additionally, the VA insures a quarter of the loan amount for loans over $144,000. Therefore, you can multiply that entitlement amount, $106,024, by four for a maximum loan amount of $424,100.

Comments

Post a Comment