VA Home Loan Limits: How Much Can You Actually Borrow?

Table of Content

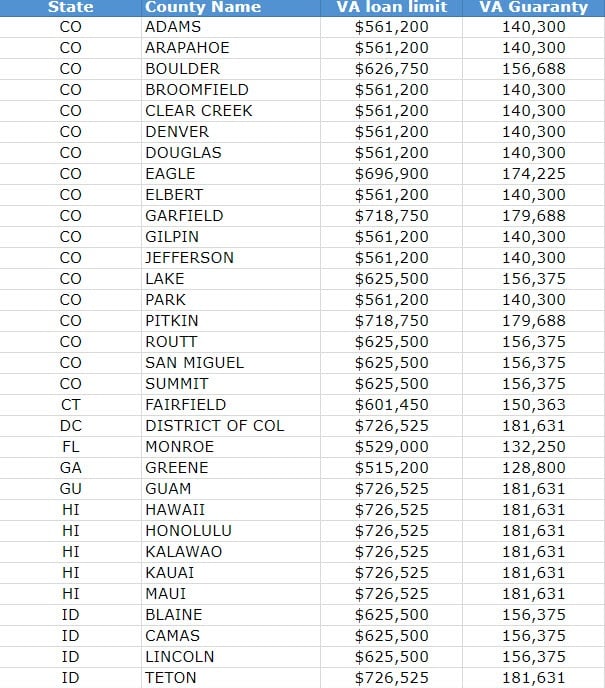

While these new loan limits are effective immediately, loans using the new limit must close on or after January 1, 2023. For example, if you want to buy a home that costs $747,200 in a county with a loan limit of $647,200, you would likely need to make a $25,000 down payment . If youre a military servicemember or veteran, you may have access to a zero-down loan with no limit, as long as you qualify for the payment.

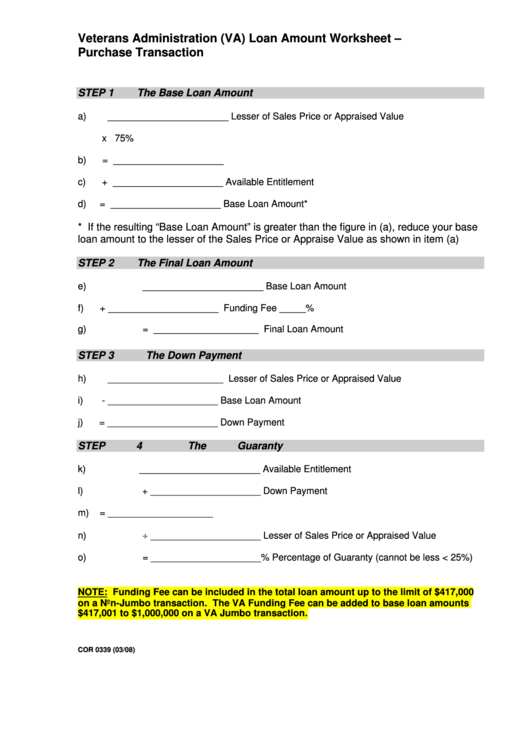

So, you could potentially get a loan up to $347,200 without having to make a down payment. Most of these codes correspond with specific wartime or peacetime periods and indicate how you earned your entitlement. We believe it’s your family’s turn to live the American Dream and enjoy this Great Country you’ve sacrificed for. By working with an experienced VA Lender, they’ll help you get the biggest bang for your VA entitlement buck. For example, the VA would always guarantee $36,000 towards the VA Home Loan if the total is below $144,000.

Whats My Va Loan Limit

Your lender will look at your income, debts and credit history to determine how much they’re willing to lend you. If you’ve never gotten a VA loan before or you’ve paid off a previous VA loan in full and sold the property the loan was used to purchase, you should have full entitlement. VA loan entitlement refers to the amount the Department of Veterans Affairs will guarantee on a given borrower’s VA loan. In other words, it’s the maximum amount the VA will repay your lender if you default on your loan. Your length of service or service commitment, duty status and character of service determine your eligibility for specific home loan benefits. You can also use the VA Loan to purchase a home with a maximum loan amount that’s equal to or less than the remaining entitlement.

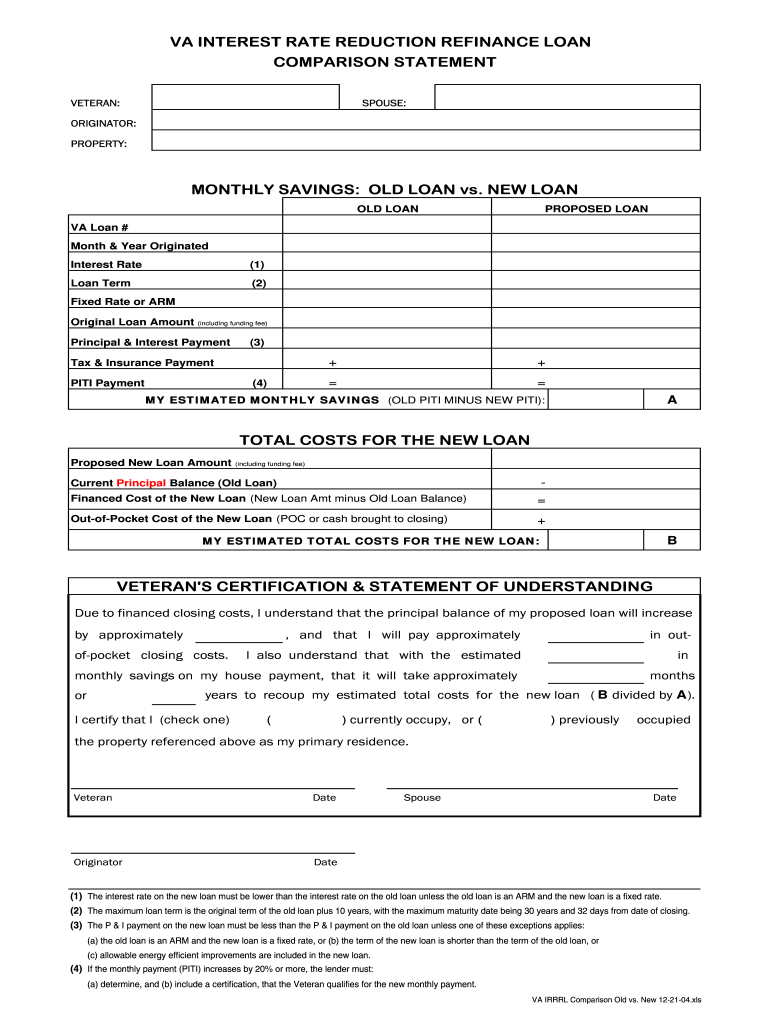

Reach out to the VA and other veterans groups if you need to. Get a Quote A VA approved lender; Not endorsed or sponsored by the Dept. of Veterans Affairs or any government agency. Want to take cash out of your home equity to pay off debt, pay for school, or take care of other needs? Find out if you can get a VA-backed cash-out refinance loan. The minimum active-duty service requirements depend on when you served.

Get the Military Insider Newsletter

This means you’ll have to buy your home with your remaining entitlement. However, if you have a reduced entitlement, you likely won’t be able to borrow up to the maximum with no down payment. You can determine your remaining entitlement by subtracting the entitlement you’ve already used from the maximum entitlement amount.

In a purchase, veterans may borrow up to 103.6% of the sales price or reasonable value of the home, whichever is less. Since there is no monthly PMI, more of the mortgage payment goes directly towards qualifying for the loan amount, allowing for larger loans with the same payment. In a refinance, where a new VA loan is created, veterans may borrow up to 100% of a property's reasonable value, where allowed by state laws.

Sep VA Loan Limits 2021: Maximum Amount by State

However, VA loan limits are a max on what you can buy without a down payment. In addition to the VA mortgage limits set by the FHFA, your private lender might also set a specific limit on you, regardless of whether you have entitlement or not. These limits could depend upon your credit score, credit situation and monthly income. On average, the maximum VA mortgage limit for borrowing a loan in most counties is $647,200. This means that applicants with partial or no entitlement can borrow a VA home loan worth $647,200 without making a downpayment. And, if an applicant has no or partial entitlement, they will be subjected to Va loan limits.

Borrowers who’ve lost a VA loan to foreclosure will have reduced VA loan entitlement, which will limit how much they can borrow without making a down payment. … Some borrowers may have some basic VA loan entitlement remaining, while others may be able to purchase again using their second-tier entitlement. Keep in mind, if you have full VA entitlement, VA loan limits won't apply. If you're unsure if you have remaining entitlement, Veterans United is here to help. Veterans with reduced VA loan entitlement must still follow VA loan limits.

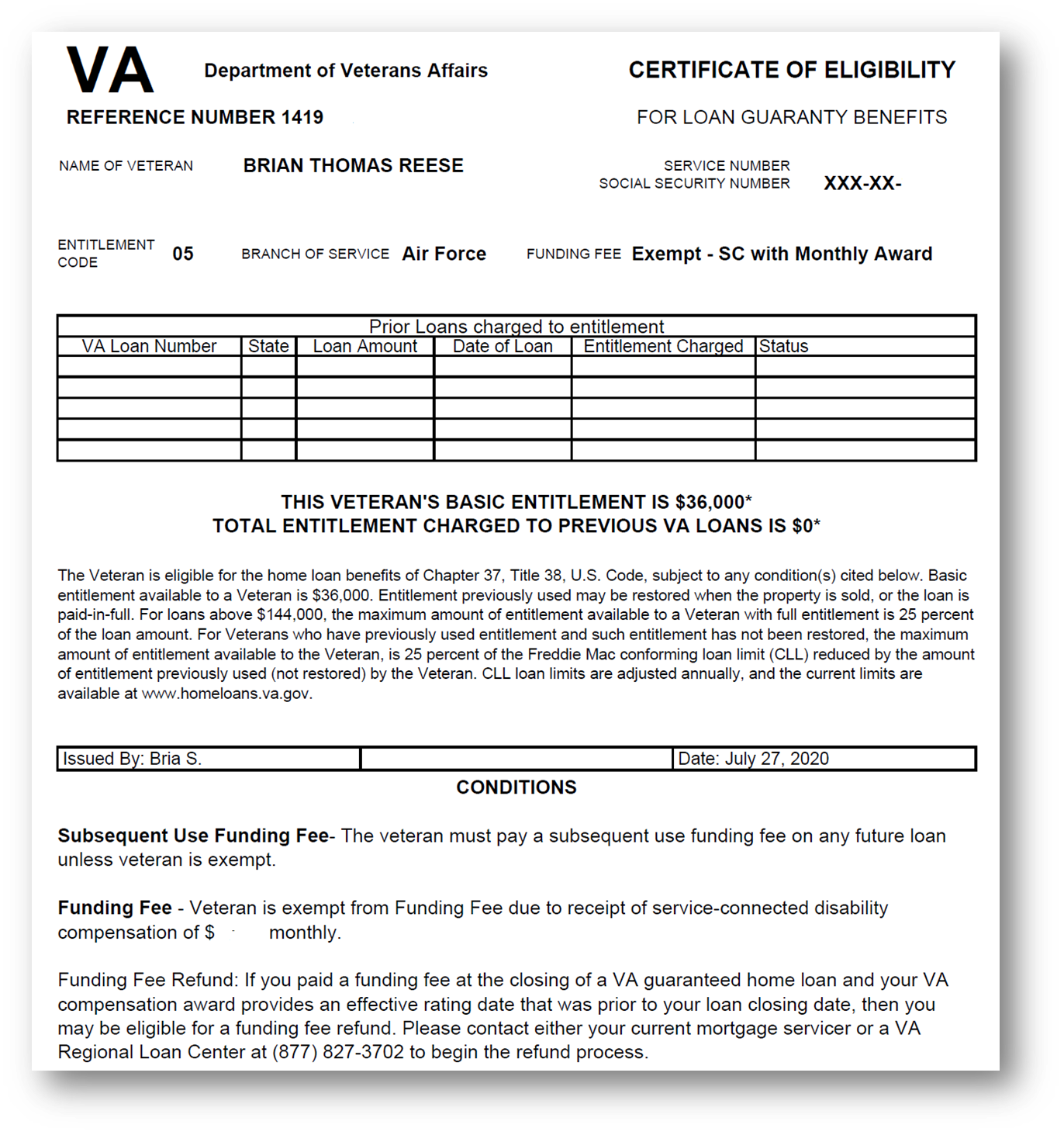

What Document Does The Va Use To Determine The Amount Of A Veterans Entitlement

If you have reduced entitlement and want to know how much you have left, you’ll need to figure out how much of it you’re currently using. If you’re experiencing financial hardship due to the COVID-19 emergency, you can request a temporary delay in mortgage payments. Jimmy Vercellino, a Marine veteran, specializes in helping military veterans benefit from the VA Loan Program and buy the home of their dreams.

The restriction to this is that the total of all VA loans may not exceed $144,000 unless it is one loan . The Veterans Housing Act of 1970 removed all termination dates for applying for VA-guaranteed housing loans. This 1970 amendment also provided for VA-guaranteed loans on mobile homes. The VA Lender’s Handbook states that VA loan entitlement can be restored when the prior VA mortgage has been paid in full either by refinancing, selling the home, or paying off the loan amount. If you don’t have full entitlement and don’t qualify for a one-time restoration, you can figure out how much remaining entitlement you have by using the formulas discussed above. If you’ve used your basic entitlement, how do you figure out how much bonus entitlement you have?

COE is the document proving that active-duty service members and veterans meet the service requirements to be eligible for a VA home loan. It’ll also contain information about your entitlement amount. As of January 1, 2020, VA loan borrowers with full entitlement don’t have a limit on how much they can borrow with a 0% down payment.

Entitlement can be confusing for even the most experienced mortgage professionals. In most areas of the country, basic entitlement is $36,000. Adding those together gives you a total of $106,024 for eligible veterans. In higher cost areas, it may be even more.Additionally, the VA insures a quarter of the loan amount for loans over $144,000. Therefore, you can multiply that entitlement amount, $106,024, by four for a maximum loan amount of $424,100.

It’s a perfect time to buy a home near your station or to settle down near family in your last home. The VA is a government agency that understands you and your partner may be stationed or retiring in a more expensive part of the country, such as California. They adjust VA Loan Limits according to the cost of living of the particular county. Calculating your remaining VA Entitlement can be done on your own or with the help of an experienced lender. Basic, 2nd Tier, and remaining entitlement calculations are the most common we see with the home buyers we work with.

This loan program is a private sector equivalent to the Federal Housing Administration and VA loan programs. Despite a great deal of confusion and misunderstanding, the federal government generally does not make direct loans under the act. The government simply guarantees loans made by ordinary mortgage lenders after veterans make their own arrangements for the loans through normal financial circles. The Veterans Administration then appraises the property in question and, if satisfied with the risk involved, guarantees the lender against loss of principal if the buyer defaults. Take a look at the different conforming loan limits for each county.

Most states have the standard VA Loan Limit of $647,200 and make it simple to calculate your 2nd tier entitlement. If you don’t meet full entitlement, then you are subject to conforming loan limits set by the Federal Housing Finance Agency , which are typically adjusted every year. VA Loans are available up to $548,250 in most areas but can exceed $800,000 for single-family homes in high-cost counties. Your VA loan limit or how much you can borrow without making a down payment is directly based on your entitlement.

Comments

Post a Comment